Mariah Lichtenstern, Founder of DiverseCity Ventures, pictured.

By Mariah Lichtenstern, Founding Partner of DiverseCity Ventures and Winter ’20 Aspen Tech Policy Hub Fellow

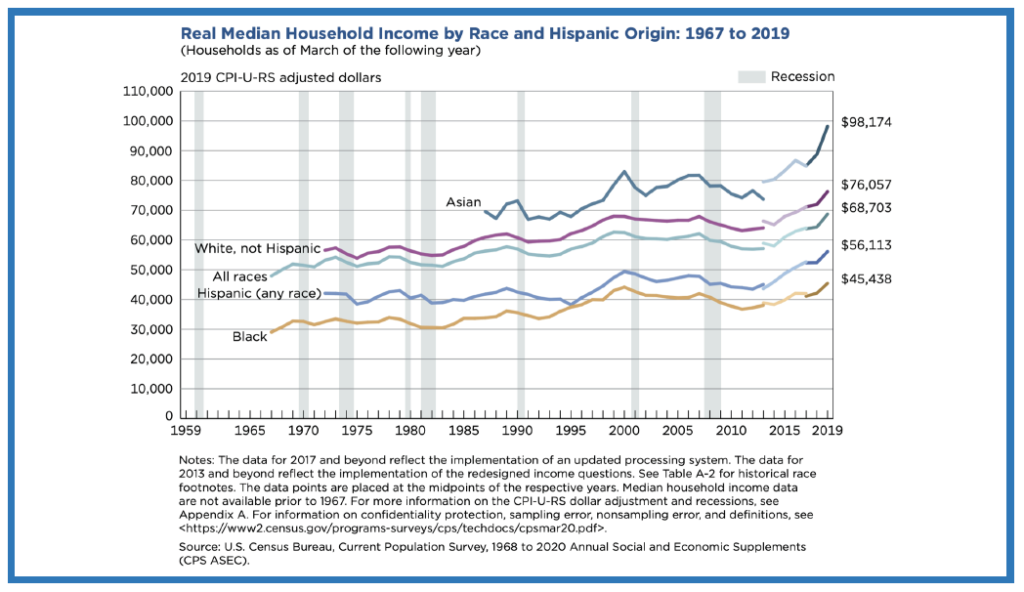

According to Jada McLean, Co-Founder of Hurry Home, an affordable homeownership marketplace and investment management platform, modern-day ownership is still out of reach for too many Black households. The median income of the average first-time buyer is $80 thousand, while the median income for Black households is $45 thousand. Even though thousands of homes are listed under $100 thousand in top U.S. cities, underwriting and biases around credit-worthiness create barriers that pick up where codified redlining left off – preventing Black prospective buyers from owning affordable homes.

A former Banking Analyst, McLean believes that the core problem is that approximately 1/3 of US housing stock is inaccessible to aspiring homeowners because of the regulation and profit structure of the banks. While piloting their startup in South Bend, Indiana, McLean and her Co-Founder, John Gibbons, found that 12% of houses were under $50 thousand. There was also a surprising number of rent-to-own or land contact buyers – both suboptimal for prospective homeowners. Many would-be homeowners had income, credit scores, and savings sufficient to qualify for a mortgage on an affordable home, but still could not get approved. Gibbons cites misaligned incentives driven by the Home Ownership and Equity Protection Act (HOEPA), which caps mortgage closing costs at 5% of a borrower’s loan. For an affordable home below $100K, appraisals, loan fees, and other processing vendors can quickly exhaust this limit, dipping into banks’ revenue. Since banks generally are paid 1-2% of the loan amount but have to do the same amount of work whether a loan is $50 thousand or $500 thousand, small loans are disfavored. Many of these sub-$100K houses are bought with cash by institutional or “fix and flip” investors before becoming rental properties.

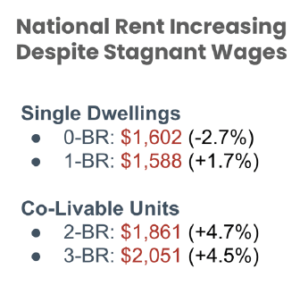

While the top quartile of income earners can buy homes with cash and charge rents, 58% of Black households are left renting with 56% of Black renters paying more than 30% of their monthly income in housing costs. These costs continue to rise, despite stagnant wages, leading to displacement and gentrification. Compounded by the impacts of Covid-19 and a widening wealth gap, Black communities are extremely vulnerable.

“Black women are the highest educated U.S. demographic, but education does not close homeownership or wealth gaps.”

“Most of Hurry Home customers are minority women. A lot of Black women have transitioned to homeownership with us. They are 38-45 buying their first home. Even though they’ve been amazing renters, they’ve never been able to make the jump to homeownership – through no fault of their own. They pay their rent on time, they operate in cash, they are a good credit risk, but they are not ‘seen’ by the credit system. They don’t have equitable access to generational wealth or traditional mortgage products.” – Jada McLean, CEO, Hurry Home.

Black women are the highest educated U.S. demographic, but education does not close homeownership or wealth gaps. In fact, Black women are disproportionately negatively impacted by student loans, particularly when pursuing graduate / professional degrees that produce higher wages. Student loans contribute to high debt-to-income ratios (compounded by the wage gap), which make it more difficult to qualify for higher loan amounts. Women also encounter more bias and social barriers to accessing credit. Barriers to homeownership close doors on valuable tax deductions and access to equity for education, investments, withstanding emergencies, and starting businesses. As housing costs continue to rise, affordable home loans are a key stepping stone to economic stability and wealth creation.

To make affordable homeownership more accessible, HOEPA could be amended to cap costs at a percentage of the average or mean loan amount. Banks could be incentivized to make smaller loans with rebates for closing costs. Student loans, which are exempted from bankruptcy, could be excluded from debt-to-income calculations on FHA loans. In this way, those whose lack of generational wealth leaves them with a greater debt burden can have a better shot at wealth creation, instead of going deeper into a hole of debt peonage.

The Biden administration is making the redress of discriminatory housing policies and practices a priority. While driving awareness of affordable homeownership inequities and advocating for fair housing policy, Black women can be proactive by pooling resources to fund clusters of cash purchases in Black communities. These portfolios can be sold via wrap-around contracts to lower-income owner-occupants. Investors can secure commercial grade loans for these portfolios within special purpose vehicles (SPVs) so that pooled funds can be invested again and again. Properly structured and managed, these investments can produce wealth-generating cash flow while supporting buyers in accelerated homeownership. With technological advances available to support such strategies, and Black women positioned to address historical wrongs, the American dream of affordable homeownership can become a reality for Black women.